All About SUNNY Loan: Advantages, How to Apply and Interest Rates

O SUNNY Loan It is an ideal financial solution for different consumer profiles, whether they are young adults.

Or those looking for their first credit, retirees, small business owners or families in need of financial support.

Knowing the specifics of this product can make all the difference in choosing the best credit option for your needs.

In this article, we will detail everything you need to know about SUNNY Loan, including its advantages, how to apply, the necessary requirements.

Also the types of loans available and the applicable rates and conditions.

Our practical and straightforward approach will help you better understand this financial alternative and make an informed decision.

Keep reading to find out how the SUNNY Loan It could be the financial solution you are looking for.

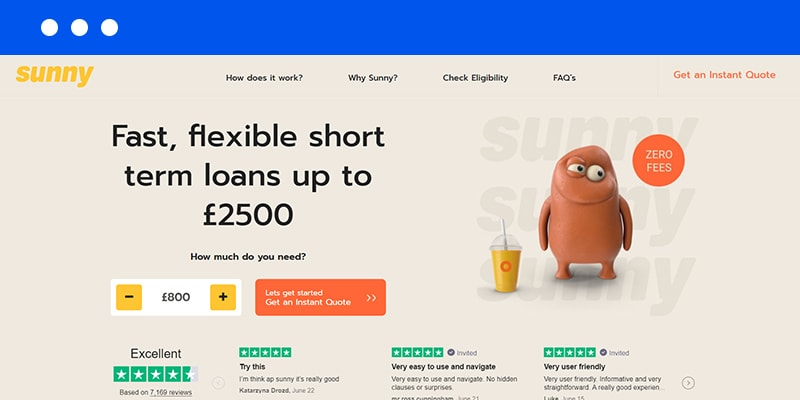

What is the SUNNY Loan?

O SUNNY Loan It is a type of credit that offers advantageous conditions for different customer profiles.

This type of loan stands out for its flexibility and personalized options that meet the specific needs of young adults, retirees, small business owners and families.

Whether to finance a large purchase, expand your business or cover medical and educational expenses, the SUNNY Loan offers a reliable and affordable solution.

Advantages of the SUNNY Loan

O SUNNY Loan It has several benefits that make it an attractive choice for those looking for credit. Some of the key advantages include:

- Competitive interest rates: Interest rates are very competitive, making the loan more affordable.

- Payment flexibility: Flexible conditions that allow you to adjust payment according to your possibilities.

- Simplified application process: Less bureaucracy and a faster approval process.

- Expert support: Service team ready to help at every stage of the process.

How to Apply for the SUNNY Loan

Request the SUNNY Loan It is a simple and straightforward process. Below is a detailed step-by-step guide to help you complete the request without hassle:

- Visit the official SUNNY website:

- Open your internet browser and enter the address of the official SUNNY website.

- Once on the website, locate the main menu or navigation bar.

- Look for the “Loans” section and click on it to be redirected to the specific loan page.

- Complete the request form:

- On the loans page you will find an application form.

- Enter all your personal details, including full name, date of birth and telephone number.

- Also add your financial information, such as monthly income and fixed expenses.

- Please ensure you complete all required fields to avoid delays in processing your request.

- Submit the required documentation:

- Prepare the required documents before starting the request to speed up the process.

- Documents typically include:

- Identity document

- Proof of income: Payslips, bank statements or income tax returns.

- Proof of address: Recent electricity, water or telephone bill.

- Upload these documents directly to the website by following the instructions provided.

- Wait for the credit analysis:

- After submitting the documentation, the SUNNY team will begin the credit analysis.

- This process may take a few business days, depending on the complexity of your financial situation.

- Keep an eye on emails and messages from the SUNNY team for any updates or additional document requests.

- Receive credit:

- If your request is approved, you will be notified by email or phone.

- The loan amount will be credited directly to the bank account provided during the application.

- Be sure to check the terms and conditions of the loan before using the funds.

By clicking the button you will be redirected to another website.

Requirements to Apply for the SUNNY Loan

To request the SUNNY Loan, it is necessary to meet some basic requirements. Please have the following documents and information on hand to ensure your request is processed smoothly:

- Identity document:

- It can be the RG (General Registration) or the CNH (National Driving License).

- The document must be valid and in good condition.

- Proof of income:

- This could be pay stubs from the last three months, recent bank statements or income tax returns.

- These proofs must demonstrate your ability to pay and the regularity of your income.

- Proof of address:

- Recent electricity, water or telephone bills.

- The proof must be in your name and with an updated address.

- Minimum age:

- You must be at least 18 years old to be eligible for the SUNNY Loan.

By following this step by step and meeting all the requirements, you will be prepared to request the SUNNY Loan efficiently and increase your chances of approval.

Types of Loans Available

SUNNY offers different types of loans to meet different needs:

- Empréstimo pessoal: For any personal purpose.

- Payroll loan: Dedicated to retirees and pensioners.

- Business loan: For small business owners looking to expand their business.

- Education Loan: To finance studies and courses.

Fees and Conditions

Interest rates and conditions of SUNNY Loan They are quite competitive and vary depending on the modality chosen and the profile of the applicant. Below is some important information:

- Interest rate: Rates may vary, but are always competitive in relation to the market.

- Payment deadlines: Flexible deadlines that adjust to your payment capacity.

- Conditionalities: There may be specific requirements depending on the type of loan.

Interest Rates

| Type of Loan | Interest Rate (%) | Payment Term | Description |

|---|---|---|---|

| Personal loan | From 1,99% | Up to 48 months | For any personal purpose. |

| Payroll loan | From 1.5% | Up to 60 months | Ideal for retirees and pensioners. |

| Business Loan | From 2.5% | Up to 36 months | For small business owners to expand their business. |

| Education Loan | From 1.8% | Up to 24 months | To finance studies and courses. |

By clicking the button you will be redirected to another website.

Conclusion

O SUNNY Loan offers a practical, reliable and affordable solution for different consumer profiles.

With competitive interest rates, payment flexibility, and a streamlined application process, it's an excellent option for financing your needs.

Whether you are a young adult, retiree, small business owner or part of a family seeking financial support, the SUNNY Loan could be the answer you are looking for.

Explore the options and see how it can fit into your financial planning. Keep exploring our detailed information to make the best decision.

Frequently Asked Questions (FAQ)

- What is the SUNNY Loan approval deadline? Approval time may vary, but is usually quick, taking just a few business days.

- Can I apply for the SUNNY Loan even with name restrictions? Yes, some modalities allow requests even with restrictions, but are subject to credit analysis.

- What collateral is required for the SUNNY Loan? Depending on the modality, some form of guarantee may be required, such as a loan for retirees.

- How do I track the status of my request? You can track the status directly on the SUNNY website or by contacting customer support.

- Is it possible to renegotiate the payment term for the SUNNY Loan? Yes, SUNNY offers renegotiation options to adapt the payment term to your needs.