Citibank Loan Highest Approval Rate in the World

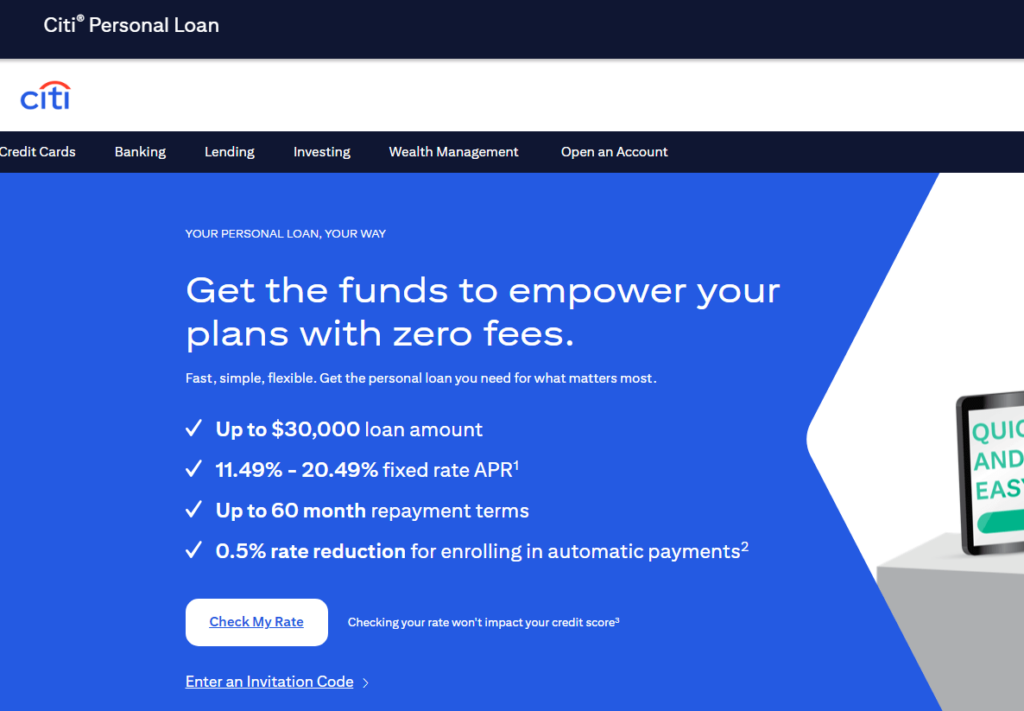

Citibank Loan: Citibank is one of the most renowned financial institutions in the world.

Your services loan They are highly sought after by people with different credit profiles.

One of the main reasons for this popularity is the high approval rate for its loans.

By clicking the button you will remain on this website.

Even for those with a less favorable credit history.

In this article, we'll explore the reasons behind this success and how you can take advantage of them.

Understanding Citibank's loan approval process is crucial for anyone seeking financing for large purchases or needing credit to overcome financial difficulties.

Additionally, we will compare Citibank to other financial institutions, highlighting why it stands out in the global lending market.

Keep reading to discover the steps in the approval process.

From Citibank loans, practical tips to increase your chances of approval and a detailed analysis of how it compares to other credit options available on the market.

Don't miss this opportunity to learn more about one of the best loan options available today!

Why Citibank?

Citibank stands out in the financial market for several reasons.

Firstly, its long history and solid reputation provide a foundation of trust for customers.

Furthermore, the bank offers a wide range of financial products that meet different needs, from personal loans to real estate and business financing.

This versatility makes it an attractive option for many.

Another significant differentiator for Citibank is its customer-centric approach.

The bank continually invests in technology to facilitate access and management of loans, providing intuitive digital platforms and high-quality customer support.

This not only improves the user experience but also speeds up the approval process.

Additionally, Citibank adopts credit assessment criteria that take into account a variety of factors in addition to the traditional credit score.

This means that people with a bad credit history still have a significant chance of getting approved as long as they can present a solid justification and show the ability to pay.

Approval process

The loan approval process at Citibank is structured and transparent, which contributes to its high approval rate.

Here are the main steps involved:

- Initial Request: The customer fills out a request form online or in person, providing basic information.

- Credit analysis: The bank carries out a profile assessment of the applicant.

- Documentation: It is necessary to present identity and residence documents. Depending on the type of loan, additional documents may be requested.

- Assessment and Approval: After analyzing and checking the documents, the bank makes a decision. If approved, the customer is notified and loan terms are discussed.

- Loan Release: Once the terms are accepted, the loan is released to the customer's account, usually within a few business days.

By clicking the button you will remain on this website.

Comparative

When compared to other financial institutions, Citibank stands out in several aspects:

- Approval Rate: Citibank has one of the highest loan approval rates in the world, surpassing many competitors that adopt more stringent criteria.

- Product Flexibility: While some banks specialize in specific types of loans, Citibank offers a wide range of options, serving both individuals and businesses.

- Technology and inovation: Continuous investment in technology facilitates the loan application and management process, providing a more agile and convenient experience for customers.

- Customer service: Citibank is known for its excellent customer service, with support available across multiple channels and in multiple languages.

- Rating criteria: By considering factors beyond a traditional credit score, Citibank offers a greater chance of approval for a wider range of customers.

Tips to Increase Approval

To increase your chances of being approved for a loan at Citibank, consider the following tips:

- Keep your Finances Organized: Have strict control of your personal finances, avoiding late payments and keeping your bills up to date.

- Prepare Documentation: Make sure you have all required documents ready and organized before beginning the application process.

- Consider a Co-Signer: If your credit history is less than favorable, consider asking for a co-signer with good credit to strengthen your application.

- Explain your situation: If you have had credit problems in the past, prepare a clear and honest explanation of the circumstances and how you overcame those challenges.

- Show Payment Capacity: Prove that you have a stable and sufficient source of income to cover the loan installments.

By clicking the button you will remain on this website.

Conclusion

Citibank stands out in the global lending market for its exceptionally high approval rates and customer-centric approach.

Understanding the approval process and following practical tips can significantly increase your chances of getting a loan.

With a broad range of financial products and a commitment to innovation and customer service, Citibank continues to be a leading choice for those seeking financing.

Frequently Asked Questions (FAQ)

- What is the average approval rate for loans at Citibank? The approval rate may vary, but Citibank is known for its high approval rates compared to other banks.

- What are the main documents required to apply for a loan at Citibank? The main documents include proof of income, identity, and residence, as well as additional documents depending on the type of loan.

- Can I get a loan from Citibank with a bad credit history? Yes, Citibank considers a variety of factors in addition to credit score, increasing the chances of approval for those with an unfavorable credit history.

- How long does it take to get approved for a loan at Citibank? Approval time may vary, but generally takes a few business days after all required documents have been submitted.

- Does Citibank offer customer support for the loan application process? Yes, Citibank offers customer support across multiple channels and in multiple languages to help with the loan application and management process.

I hope this article meets your expectations! If you need anything else or adjustments, please let me know.